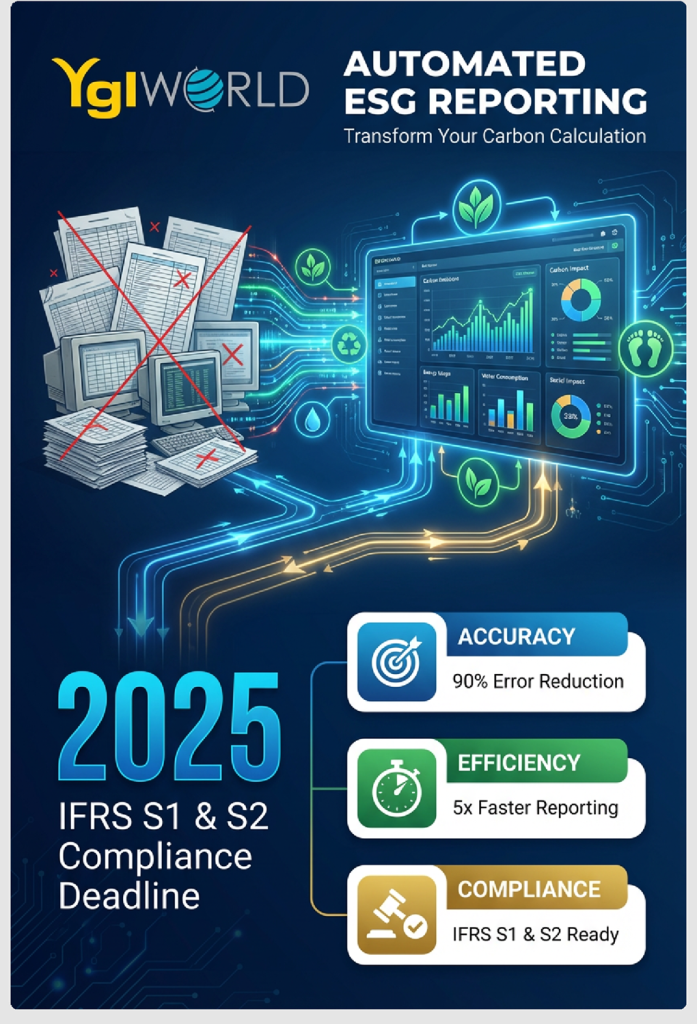

YGL ESG Middleware: Transforming sustainability reporting with automated solutions

In the rapidly evolving landscape of corporate sustainability, the era of managing Environmental, Social, and Governance (ESG) data through disconnected spreadsheets is coming to an end. As regulatory frameworks tighten and stakeholder scrutiny intensifies, sustainability leaders face a critical choice: continue wrestling with error-prone manual processes or embrace the precision of automation.

For decades, Excel has been the default tool for carbon accounting. However, recent data suggests this reliance is becoming a liability. According to KPMG’s 2024 ESG Reporting Survey, while 47% of large companies still rely on spreadsheets, many are discovering that manual methods are insufficient for the complexity of modern compliance. With impending regulations like the IFRS S1 and S2 standards on the horizon, the shift toward intelligent ESG Middleware is no longer just a technological upgrade—it is a strategic necessity.

Automated ESG Compliance: IFRS S1 & S2 Requirements

The urgency for automated solutions is driven by a concrete regulatory timeline. Malaysia is stepping up its commitment to global sustainability standards with the adoption of the International Financial Reporting Standards (IFRS) S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and S2 (Climate-related Disclosures). This shift introduces a rigorous new era of accountability.

The rollout is structured in distinct phases, ensuring that businesses of all sizes must eventually comply. Understanding where your organization fits into this timeline is crucial for strategic planning:

| Effective Date | Target Group | Requirement |

| 1 January 2025 | Group 1 Main Market listed companies with market capitalization ≥ RM2 billion. | Adoption of IFRS S1 & S2 disclosures. |

| 1 January 2026 | Group 2 Other Main Market listed companies, ACE Market listed companies, and non-listed companies with annual revenue ≥ RM2 billion. | Joins reporting framework. |

| 1 January 2027 | Group 3 Broader implementation. | Reporting begins; Assurance for Scope 1 & 2 GHG starts. |

Furthermore, from 2027 to 2030, a gradual rollout of Scope 3 (value chain) emissions reporting will commence. This inclusion of indirect emissions adds exponential complexity to data collection, making manual entry virtually impossible to manage accurately.

Manual vs Automated ESG Reporting: Hidden Risks

Despite the high stakes, a perception gap persists. While 83% of executives believe they are ahead of their peers in ESG reporting, the reality on the ground often tells a different story. Manual data collection processes are fraught with risks that can undermine corporate credibility.

Common pitfalls of manual reporting include:

- Data Entry Errors: Simple typos, such as a decimal point shift, can result in 10x overestimated emissions.

- Broken Formulas: Complex spreadsheet links frequently break, leading to cascading calculation errors that go unnoticed.

- Audit Trail Deficiencies: Manual spreadsheets rarely offer a reliable history of changes, making third-party verification difficult and costly.

- Resource Drain: Sustainability teams spend an average of 15+ hours per month on data entry and validation—time that should be spent on strategy.

YGL ESG Middleware: Automated Reporting Solutions

To address these challenges, YGL Intelligent Technology Sdn Bhd has introduced an ESG Middleware Solution designed to bridge the gap between raw operational data and audit-ready sustainability reports. This platform moves beyond simple calculation, offering a comprehensive ecosystem for carbon accounting.

1. Enhanced Accuracy with Automated ESG Data Integration

The YGL solution eliminates the “human error” factor by connecting directly to your data sources. Through API integration with ERP systems, IoT devices, and utility providers, the middleware automates data capture. It ensures that the correct emission factors are applied automatically, whether for electricity consumption or logistics fuel usage. This leads to a proven 60-90% reduction in data errors compared to manual entry.

2. Automated ESG Reporting: 70% Faster Efficiency

Time is a finite resource for sustainability teams. By automating the extraction and processing of data, YGL ESG Middleware delivers significant efficiency gains. Case studies indicate a reduction in reporting time by up to 70%. A process that traditionally

took over 11 hours per cycle can now be completed in under an hour, freeing up valuable staff to focus on decarbonization initiatives rather than data administration.

3. Audit-Ready Automated ESG Compliance

With regulations tightening, the ability to trace every data point is non-negotiable. YGL’s platform provides a 100% digital audit trail. Every modification, update, and calculation is tracked, ensuring full transparency. The system is built to align with major global frameworks, including:

- GRI (Global Reporting Initiative): Mapping data to standard indicators.

- GHG Protocol: Accurate measurement of Scope 1, 2, and 3 emissions.

- Bursa Malaysia: Automated generation of compliant sustainability reports.

- ISSB & SASB: Alignment with investor-focused disclosure standards.

4. Tangible ROI

Investing in ESG automation is not just a cost; it is a value driver. Beyond compliance, the system enables operational optimization. By visualizing real-time energy usage and carbon intensity, organizations can identify inefficiencies—such as energy waste in production—leading to direct cost savings. The middleware also facilitates the calculation of Product Carbon Footprints (PCF), a growing requirement for maintaining competitiveness in global supply chains.

Automated Carbon Calculation for Net Zero Goals

Automation does more than report the past; it shapes the future. YGL ESG Middleware includes powerful scenario planning tools. Companies can simulate the impact of internal reduction initiatives—such as installing solar PV or upgrading machinery—against their “Business as Usual” baseline.

“The middleware solution transformed our reporting from a dreaded monthly chore to a streamlined process with a higher confidence in our disclosures.”— Sustainability Manager, Global Manufacturing Corporation

The platform helps visualize the gap between current emissions and 2050 Carbon Neutrality targets, even recommending verified carbon offset projects for residual emissions that cannot be eliminated internally. This holistic approach ensures that your sustainability journey is data-driven, achievable, and transparent.

Why Choose Automated ESG Reporting Now

As we approach the 2025 compliance milestone for IFRS S1 and S2, the window for modernizing ESG reporting infrastructure is closing. Reliance on manual spreadsheets is no longer a viable strategy for Main Market companies or any organization serious about its reputation and operational resilience.

YGL ESG Middleware offers the digital backbone required for the modern sustainable enterprise. By ensuring accuracy, enhancing efficiency, and guaranteeing compliance, it empowers leaders to move beyond reactive reporting and drive proactive sustainability performance.

Get Started with Automated ESG Reporting

Contact YGL Intelligent Technology Sdn Bhd today to schedule a demo and discover how our ESG Middleware can prepare your organization for the future of sustainability.

Driving Sustainable Growth with YGL

YGL ESG Middleware bridges the gap between ERP and ESG, making sustainability reporting accurate, efficient, and future-ready. By integrating ESG data directly into business systems, companies can move beyond compliance to proactively drive sustainable growth.

At YGL, we believe that digital transformation and sustainability go hand in hand. Our solutions empower businesses to not only meet reporting requirements but also unlock opportunities for long-term value creation.

📞 Contact Us Today

Discover how YGL ESG Middleware can help your organization integrate ERP and ESG solutions for smarter, more sustainable business practices.

🌐 www.yglworld.com | 📱 +6012-506 1619

Let YGL help your organization lead the way.

Contact us today to learn how our AI-powered ERP can transform your finance function and future-proof your business.

By providing real-time visibility, improving inventory accuracy, enhancing compliance, and enabling intelligent decision-making, such systems empower companies to stay competitive and agile, even in the face of geopolitical and economic uncertainties.

We look forward to hearing from you. Contact us today so that we can help you with our YGL BeyondERP which is strategy Industry 4.0 ready implementation needs heading towards Industry 4.0.

YglWorld PG (HQ)

35, SCOTLAND ROAD

10450 Penang Island

YglWorld KL

Suite 9-10

Wisma UOA II,

Jalan Pinang 50450

Kuala Lumpur