What is ESG Middleware?

Middleware acts as the digital connector between your operational systems and ESG reporting tools.

It consolidates, cleans, and standardises large volumes of data — ensuring that your ESG reports are accurate, consistent, and compliant across all business units.

Fragmented Data Sources

ESG information resides across multiple systems, making consolidation time-consuming.

Lack of Real-Time Insights

Manual data entry and annual reporting delay decision-making.

Compliance Complexity

Evolving ESG frameworks such as GRI, ISSB and Bursa Malaysia requirements increase administrative workload.

Data Inconsistency

Lack of cross-department standardisation leads to errors.

High Reporting Costs

Manual processes and consultancy fees drive up operational expenses.

Limited Accountability

Without automation, tracking progress against sustainability goals is challenging.

Empowering Data-Driven

Sustainability

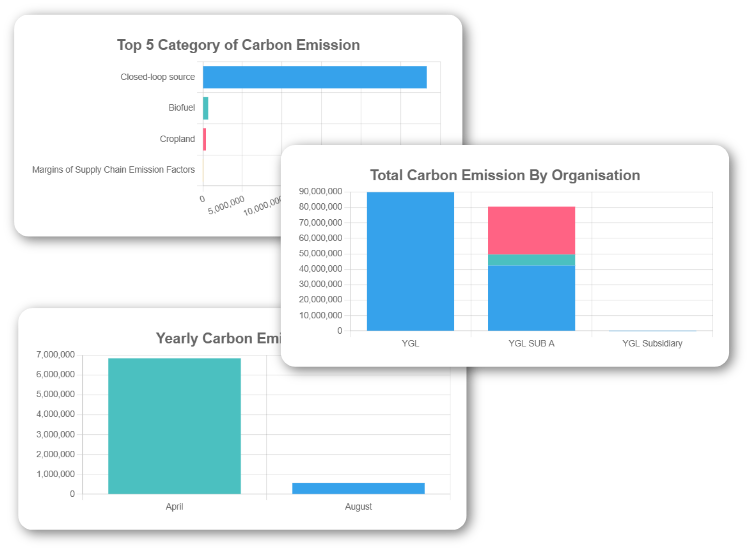

Centralised ESG data empowers organisations to turn information into insight. With real-time visibility into sustainability performance, decision-makers can analyse trends, identify risks and implement strategies that drive measurable ESG improvements

This proactive approach transforms ESG reporting from a compliance task into a powerful tool for continuous sustainability growth and smarter business decisions.

Automated ESG Data & Reporting

Instantly generate ESG reports that comply with GRI, ISSB and Bursa Malaysia standards. Automation ensures fast, accurate and consistent reporting, ready for auditor verification anytime.Real-Time Insights for Better Decisions

Gain a full view of your sustainability performance through real-time dashboards and data visualisation tools. Identify risks, spot opportunities and make informed decisions with confidence.End-to-End Data Integration

Seamlessly connect your ERP, IoT, HR and Financial systems on a single platform. Integrated data flows automatically between departments, eliminating silos and duplication of effort.Higher Transparency & Accuracy

Automated data validation ensures reliable, consistent and audit-ready ESG information. This builds stakeholders trust and simplifies external assurance or regulatory submissions.Enhanced Operational Efficiency

Save time and resources by reducing manual data entry, spreadsheets and rework. Automation minimises human errors, shortens reporting cycles and boosts productivity across the organisation.Actionable Sustainability Insights

Unlock powerful analytics to uncover carbon hotspots, inefficiencies and trends that may be hidden in traditional reports. Use data-driven insights to improve performance and drive continuous sustainability growth.

YGL AL-ESG for

Carbon Accounting &

Product Carbon Footprint

How It Works

YGL AI ESG connects with your existing systems to ensure smooth data flow and eliminate manual entry. It integrates with ERP, MES, IoT sensors and other platforms to collect real-time ESG data for accurate reporting and analysis. Powered by GenAI, it captures key information from documents and images instantly, improving efficiency and reducing errors.

Data Sources

ERP Systems

IoT Devices

Third-Party Data

ESG Middleware Platform

Utility Bills Staff Claims

Data Validation

Emissions Calculation

Report Generation

ESG Reporting Software

Dashboards

ESG Reports

Compliance

YGL AI-ESG

Seamless ERP & Accounting Integration

Pull data automatically from your ERP, general ledger and financial systems to simplify ESG reporting.

GenAI-Powered Data Capture

Uses AI to scan documents and images, capturing key ESG information quickly and accurately.

Comprehensive GHG Measurement & Tracking

Tracks and calculates Scope 1, 2 and 3 carbon emissions across your entire operations and supply chain.

Flexible Modelling & Open Integration

Supports flexible setup and easy connection with other systems through open integration.

Bursa Malaysia ESG-Ready Compliance

Complies with Bursa Malaysia’s ESG Disclosure Guide and upcoming national reporting standards.

Reporting & Compliance

Industry We Serve

Manufacturers

Monitor energy use, emissions

and supply impact.

Logistic Companies

Track fleet emissions and

optimise transport efficiency.

Banks & Insurers

Assess ESG risk for loans, refinancing and insurance underwriting.